Looking for a profitable investment in today's volatile times?

You should definitely consider buying vintage vehicles. Over the past twenty years, the classic car market has changed radically and buying vintage cars is no longer the domain of enthusiasts and collectors, but is becoming a very good tool for preserving, appreciating money and expanding your investment portfolio. Unlike stocks, cryptocurrencies and similar investment commodities, the vintage car market has shown long-term and steady growth.

If you're interested in this opportunity but don't know how to go about it, we can help. As with any other investment, whether tangible or virtual, it's important to know what's worth investing in and what's not. Based on your requirements, we can help you find your own portfolio of classic cars to diversify your funds.

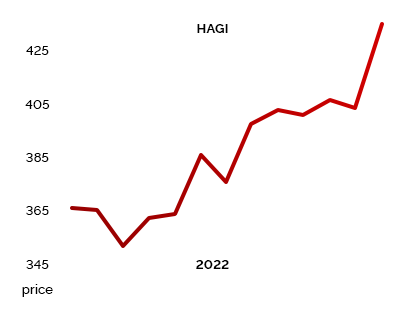

HAGI index

Historic Automobile Group International

An independent investment company with specialist expertise in the rare classic car sector. Their website allows you to track the current price trends of historic cars, including the price trends of individual brands.

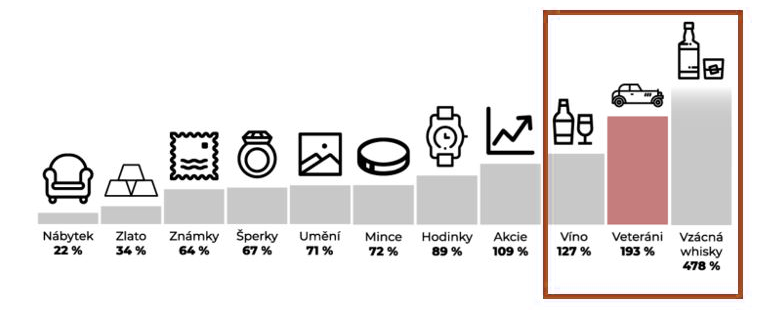

Despite the market downturn last year, affected by coronavirus measures, the collectibles market has maintained an average growth of 71% over the last 10 years.

The best performing markets have been alcohol, specifically collectible whiskey, and the vintage car market specifically. Their appreciation averaged 193%. This statistic does not only apply to cars exceptional in their time, but also to "ordinary" types of cars.

A Skoda 120, which three decades ago was owned by the majority of Czech households, sold for less than 30,000,- now its prices are around 100,000,-. For a Tatra 603 without renovation, prepare 300 000,- and after renovation up to 1.5 million crowns. Motorcycles are not left behind either. Twenty years ago, maybe worthless Jaweta or Stadion are now sold for 50 - 70 thousand crowns after renovation.

However, the greatest potential still remains in Italy. Historic cars from that country are up 8.87% p.a., with Ferrari vehicles appreciating 11.3% p.a.

We can advise you on the best way to invest in vintage cars. From selecting the right cars, to buying and restoring them, to eventually selling them. Investing in vintage cars is often a long-term investment and over time the vehicle requires some care.